Our

Company

Velocity Financial, Inc. is a vertically integrated real estate finance specialist that provides innovative financing solutions for 1–4 unit residential rental and small commercial properties since 2004.

We operate in a large and highly fragmented market with substantial demand for financing, but one with limited options available to borrowers who do not qualify for more traditional financing programs. We pioneered our unique combination of financing solutions, service and broad operational capabilities, which has driven our growth and resulted in Velocity Financial becoming a leader in serving the financing needs of investors in residential rental and small commercial properties.

We originate our loans on a national basis in 45 states and Washington, D.C., through a network of independent mortgage brokers, which we have built over 15 years in business. We leverage proprietary technology and customized operational workflows to drive efficient and consistent experience for our brokers and their borrowers.

Our management team averages more than 25 years of experience in the financial services and real estate lending industries. Under their leadership, we have successfully navigated both positive and negative economic cycles.

We believe in the quality of the loans we originate and owning the credit risk through the life of the loan. Our credit and underwriting philosophy encompass individual borrower and property due diligence, taking into consideration several factors including property value and the borrower’s credit history. Our access to 15 years of proprietary data, coupled with significant technology investments and our comprehensive operational capabilities, allows us to provide lending decisions quickly and process the loan efficiently. We also structure our loans and the related financing to provide protection against interest rate fluctuations, allowing significant visibility into future earnings. Our large in-place loan portfolio and unique financing capabilities provides us the ability to continue delivering attractive returns for shareholders in the future.

Company

Evolution

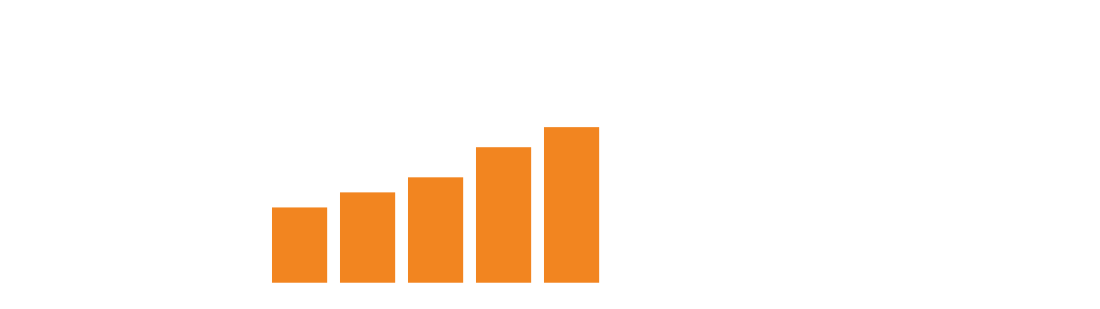

Cumulative Originations and Acquisitions Since Inception

From our inception in 2004 through September of 2007, we focused on the origination of investor real estate loans, primarily holding them for a short period of time before selling them to other financial institutions. In May of 2005, we received a minority investment from C-BASS and entered into a forward loan sale agreement with them. In late 2007, we received a significant equity investment from Snow Phipps and shifted our business strategy from selling loans to holding them for investment.

Between 2008 and 2012, we pivoted our business to focus on acquisitions of distressed commercial real estate loans, which provided opportunities for compelling risk-adjusted returns.

In 2011, we completed our first small balance commercial real estate loan securitization – a pioneering transaction in the post-crisis era, comprised of acquired loans and our own originations.

In 2013, we expanded our loan origination business to include investor 1-4 residential rental loans, which has grown to become our leading product. In late 2016, we raised additional equity capital from an affiliate of a fund managed by PIMCO, LLC. We have become a regular issuer of MBS collateralized primarily by the loans we originate, and since 2014, we have completed a total of 12 securitizations.